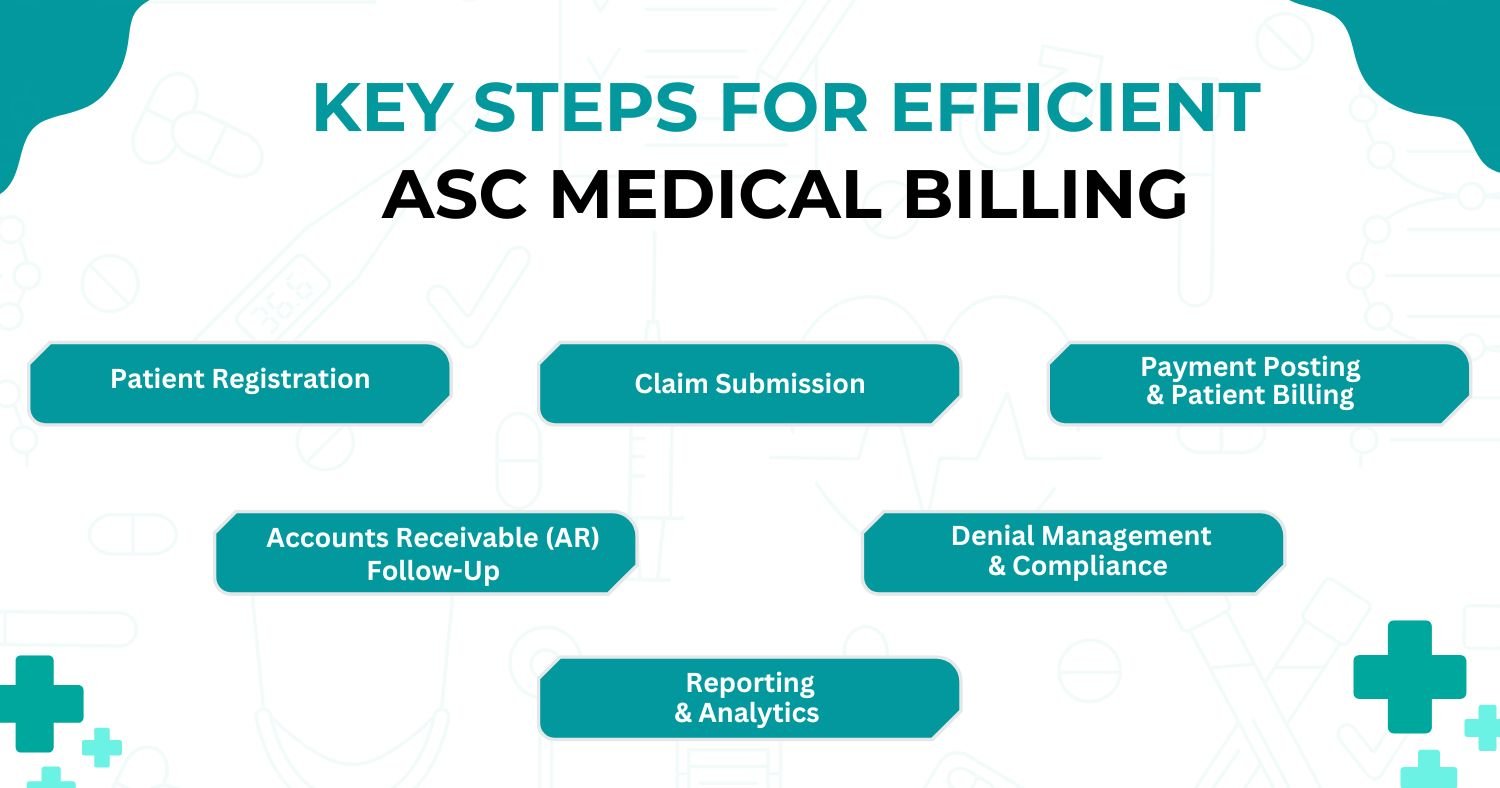

Ambulatory Surgery Centers (ASCs) provide a cost-effective alternative to traditional hospital surgeries. However, for ASCs to maintain financial stability, optimizing the medical billing process is essential. ASC medical billing has its own complexities, and understanding the key steps involved in the billing workflow can ensure timely payments and a smooth revenue cycle.

The infographic above highlights the critical stages of the ASC medical billing process. Let’s explore each step and how outsourcing ASC billing can improve efficiency and profitability.

1. Patient Registration

Accurate patient information is essential in ASC billing, ensuring that all necessary details, such as coverage, policy limits, and copays, are collected upfront. This step helps prevent denials and costly errors, while also enhancing patient satisfaction. However, managing these details can be time-consuming and error-prone. Partnering with a specialized medical billing service can streamline the process, improve accuracy, and lead to faster reimbursement, contributing to a better overall patient experience.

2. Claim Submission

Further, claims are submitted to insurance companies for reimbursement. ASC claims can be more complex due to the surgical nature of procedures and payer-specific rules. Any errors during claims submission can result in rejections. Therefore, outsourcing medical billing helps streamline the claims submission process.

4. Payment Posting & Patient Billing

Once claims are approved, payments are posted to the ASC’s accounting system, and any remaining balance is billed to the patient. Payment posting ensures that all received payments are accurately recorded, while patient billing ensures patients are aware of any outstanding amounts. A clear and efficient payment posting process is vital for financial transparency.

5. Accounts Receivable (AR) Follow-Up

AR follow-up is an essential part of ASC billing. It involves tracking unpaid or underpaid claims and taking appropriate action to recover the amount. ASCs often face higher financial risk due to the high cost of surgical procedures. Timely follow-up ensures that no claim goes unpaid for too long, helping maintain a healthy revenue cycle.

6. Denial Management & Compliance

ASCs are particularly vulnerable to denials due to the complexity of surgical procedures and payer requirements. Effective denial management involves identifying the cause of denials, resolving them, and ensuring compliance with industry regulations. Outsourcing denial management to third-party medical billers can significantly enhance this process, as they have the expertise to handle complex denials efficiently and ensure compliance. Proactive denial management helps ASCs recover revenue that might otherwise be lost, improving financial stability and operational efficiency.

8. Reporting & Analytics

In ASC billing, reporting and analytics play a crucial role in evaluating the financial performance of the center. By analyzing data on claims, payments, and denials, ASC administrators can identify areas for improvement and optimize their billing process. Using insights from these reports can lead to increased revenue and efficiency.

Unlocking ASC Financial Health

Mastering the ASC medical billing workflow is crucial for maintaining a healthy revenue cycle and operational efficiency. Each step—from credentialing to reporting—plays a vital role in optimizing billing and ensuring timely reimbursements. Understanding key stages like patient registration, claim submissions, and denial management helps ASCs mitigate risks and improve financial performance.

Given the complexities of surgical procedures and payer requirements, a streamlined billing process reduces errors and claim rejections, allowing ASCs to focus on patient care. Outsourcing to experienced third-party providers further enhances efficiency, enabling ASC staff to concentrate on clinical duties. Concluding, mastering the billing workflow, combined with outsourcing, drives long-term financial stability in a competitive healthcare landscape.