Ensuring the financial vitality of a surgery center involves a meticulous approach to revenue cycle management. Whether billing processes are handled in-house, outsourced to a specialized company, or managed by a third-party entity, the effectiveness of these processes profoundly impacts the center’s financial well-being.

Even minor disruptions in any aspect of the revenue cycle can lead to significant repercussions, ranging from delayed payments and denials to lost revenue and compliance issues. In today’s economic climate, where reimbursements are tightening and operational expenses are escalating, surgery centers cannot afford to overlook potential revenue cycle challenges.

To safeguard against such pitfalls, it is paramount for surgery centers to continuously assess their revenue cycle health. This proactive approach enables early detection of issues and facilitates the implementation of sustainable solutions.

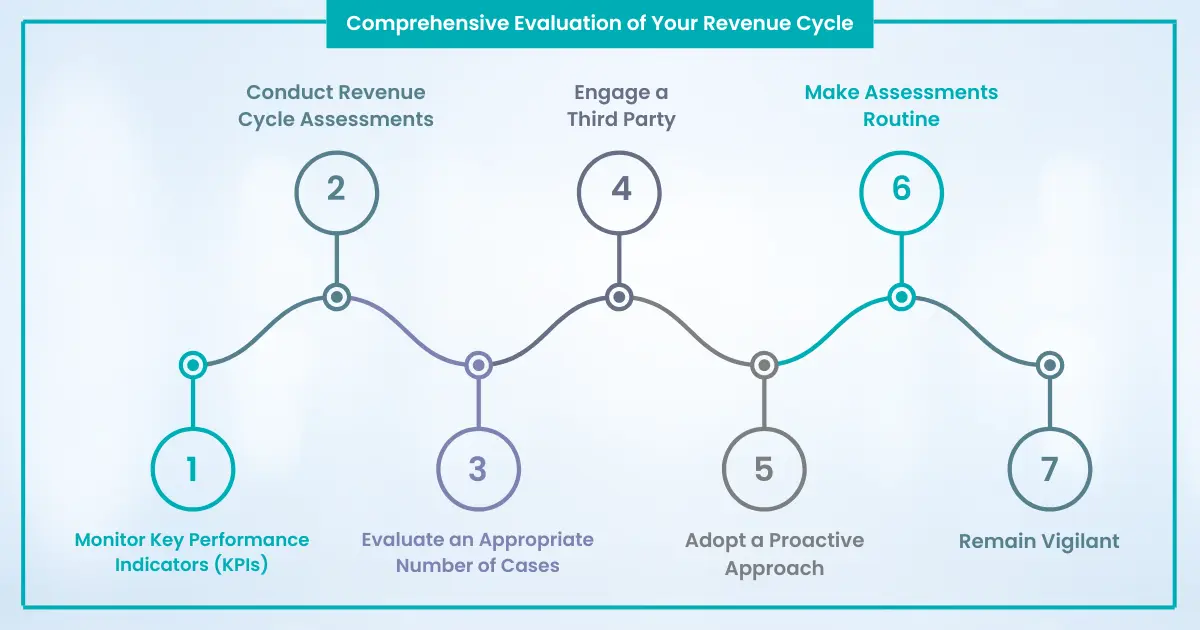

Steps To Conduct A Comprehensive Evaluation Of Your Revenue Cycle

1. Monitor Key Performance Indicators (KPIs):

Regularly track and benchmark critical KPIs such as days to bill, days to pay, accounts receivable over 90 days, and denial rate. Leveraging advanced analytics enhances insights into revenue cycle data, facilitating informed decision-making.

2. Conduct Revenue Cycle Assessments:

Perform in-depth assessments comparing your center’s performance to industry benchmarks, considering unique factors like specialties and payor mix. Randomized case evaluations ensure thorough scrutiny, revealing both minor discrepancies and major issues impacting financial stability.

3. Evaluate an Appropriate Number of Cases:

Tailor assessments to your center’s size and needs, analyzing a sufficient number of cases to yield meaningful insights. Regardless of whether billing services are outsourced, conducting assessments remains beneficial for identifying potential areas of improvement.

4. Engage a Third Party:

Collaborate with experienced third-party organizations specializing in ASC revenue cycle management to ensure objective evaluations and actionable recommendations.

5. Adopt a Proactive Approach:

Address cash flow challenges promptly by scheduling assessments without delay. Procrastination only exacerbates issues, making them harder to rectify.

6. Make Assessments Routine:

Incorporate revenue cycle assessments as a recurring practice, ideally on an annual basis, to maintain financial health and identify evolving trends.

7. Remain Vigilant:

Even if performance appears satisfactory, continue conducting assessments to uncover new improvement opportunities and validate existing practices.

In light of the complexities and critical importance of maintaining a healthy revenue cycle, outsourcing ASC medical billing to a well-established medical billing company emerges as a prudent choice. Such companies bring specialized expertise, advanced technology, and dedicated resources to optimize revenue cycle management efficiently. By entrusting this responsibility to seasoned professionals, surgery centers can streamline operations, mitigate risks, and focus on delivering exceptional patient care. Therefore, considering the significant benefits it offers, outsourcing ASC medical billing to a reputable company stands out as a strategic decision for ensuring long-term financial viability and success.